Tucker Carlson’s Bullsh*t Take on Crypto Privacy — How CashFusion and BCH Covenants Can Aid Agorists in Free Trade

Tucker Carlson’s Bullsh*t Take on Crypto Privacy — How CashFusion and BCH Covenants Can Aid Agorists in Free Trade

For those who saw the recent Tucker Carlson interview with Roger Ver — who is currently being held in Spain on tax fraud charges leveled by the US Department of Justice — a few things didn’t add up to the careful viewer.

One, Carlson is clear controlled opposition (if being a second-generation DC darling and mass media royalty who once applied to the CIA are any sign), so why would he give such heavily promoted airtime to someone like Ver, who has spent his life so far as an unremitting thorn in the side of statism? Second, Ver was notably quiet on the crypto he has long said is the real Bitcoin, Bitcoin Cash, while promoting several other privacy solutions.

Roger, who is also known as Bitcoin Jesus, has seen legions of popular voices come to champion him in recent months, as the Donald Trump presidential hype train has reached breakneck, Mango Messiah momentum. The “FreeRoger” hashtag has become popular even with people who normally couldn’t care less about economic freedom. But where were these people seven months ago, when Ver was first caged in Spain for taxes he supposedly owed the U.S. government on Bitcoin?

Am I the only one who cannot stand this dumbass face Carlson always makes during his interviews?

Am I the only one who cannot stand this dumbass face Carlson always makes during his interviews?

Carlson Interview a Propaganda Hit Piece on Crypto

Let me cut right to the chase: After Carlson tried to hammer home the idea that crypto is not private time and time again throughout the interview, the American political commentator’s team edited clips from the video for social media, which made it seem that Roger was being investigated not for tax fraud, but because he had simply revealed the ‘shocking’ truth that the Bitcoin ledger is not private. But we all already know that. So do most people in crypto these days.

Roger, in typical principled fashion, had verbally eviscerated the ATF at the beginning of the interview, while discussing the U.S. Government’s massacre of innocent men, women, and children in Waco, Texas in 1993. But when Carlson noted that Bitcoin, and by extension crypto, weren’t private, Ver didn’t slap back as he usually does. Odd.

In fact, he said at one point he was “embarrassed” to promote Bitcoin. He has indeed said this before when talking about BTC, but with Carlson he didn’t clarify he believes there is a version of Bitcoin that still is sound, usable, and — most critically — capable of excellent privacy: Bitcoin Cash (BCH). And specifically, Bitcoin Cash with CashFusion.

Comments on Tucker’s dishonestly edited social media clip were predictable. A crowd of normie, “boomer” types gathered under the post to say yep, they knew it all along, crypto is not private and is a tool of the state. Crypto is bad and completely controlled by the government.

This would indeed be a convenient outcome for authoritarians looking to discourage the masses from permissionless, agoristic commerce. Maybe that was the whole point of the Tucker piece, and the recent fawning support from suspect, pseudo-libertarian political types like Charlie Kirk, and not to actually help Roger out.

But I digress. For what it’s worth, I still think people should sign the Free Roger petition regardless, to pressure this bullshit paradigm to let him him go. But let’s get to the real brass tacks, the thing Roger Ver was strangely silent on, a groundbreaking privacy protocol called CashFusion.

Cashfusion.org

Cashfusion.org

CashFusion, the Private Elephant in the Room

Roger did mention Bitcoin Cash in passing in the interview, but focused mainly privacy coins like Monero (XMR) and Zano (ZANO) (which I’ll be covering in subsequent articles), and other protocols being developed. But let’s look at the privacy innovation that even anarchists and the wider crypto community have slept on: CashFusion.

According to the website cashfusion.org, CashFusion is “a fully decentralized privacy protocol that allows anyone to create multi-party transactions with other network participants.” The FAQ section continues: “This process obscures your real spending and makes it difficult for chain-analysis companies to track your coins.”

CashFusion is open-source, works directly onchain, and is built into wallets like the Electron Cash wallet for BCH. It differs from “coin mixing” as users are not swapping out one set of coins for another, but mixing their transactions, or fusing their transactions/UTXOs (unspent transaction outputs), with others. According to Ver in earlier interviews, this tech has stumped even the likes of crypto-forensics firm and state-embedded surveillance giant Chainalysis.

CashFusion does rely on the Tor network, which is also not without its critics. But then, at some point, one either becomes black-pilled on everything and exits life online (not a bad idea, in my view, but not feasible at the moment for most, I guess) or does their research and chooses the best possible option given the knowledge they possess.

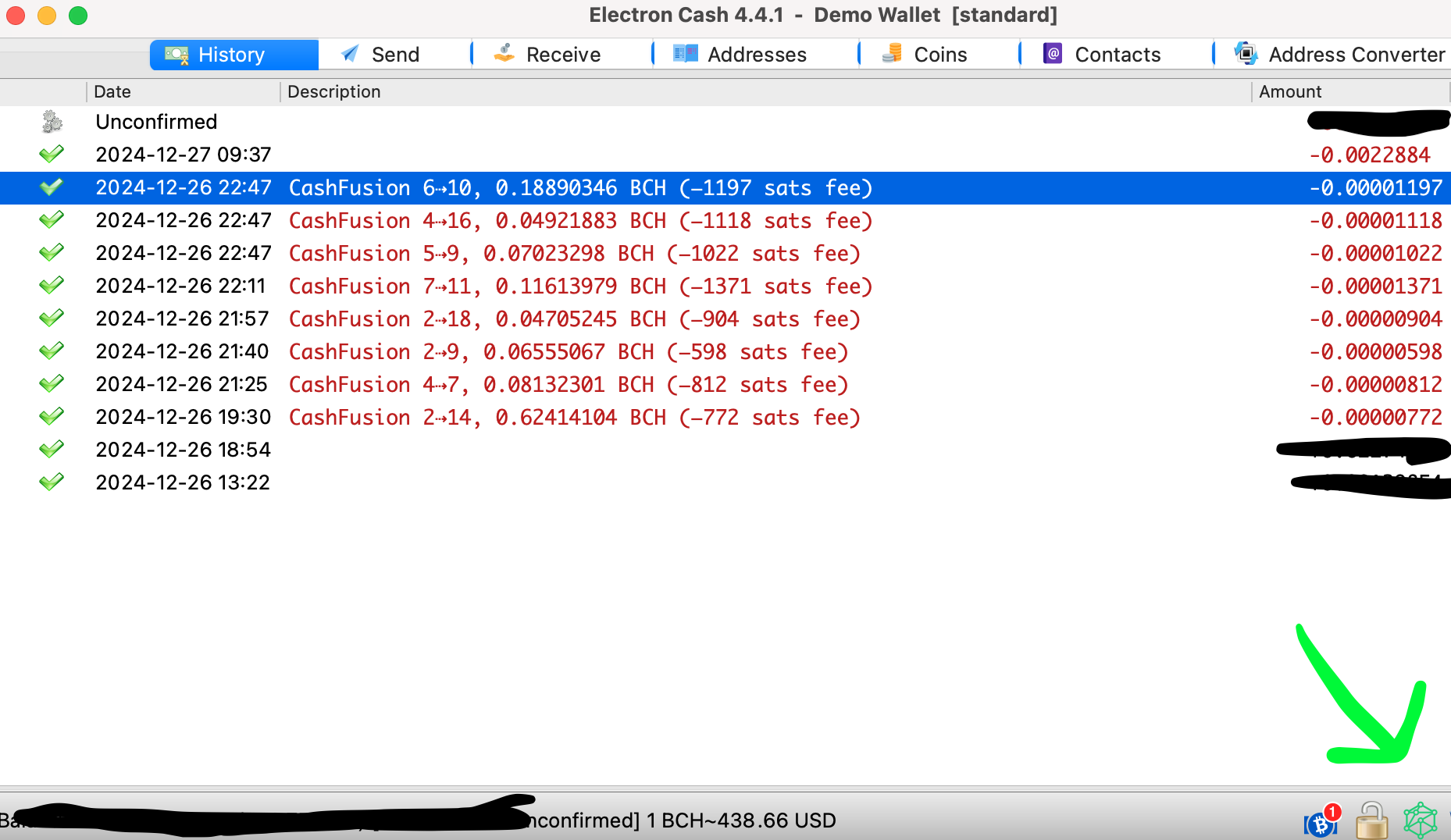

Cash Fusions happening in an Electron Cash wallet with the CF toggle on.

Cash Fusions happening in an Electron Cash wallet with the CF toggle on.

A Breakdown of CashFusion and Future Possibilities of Implementing Monero’s ‘Full-Chain Membership Proofs’ on BCH

When the CashFusion protocol was first emerging in late 2019 and early 2020, there was a lot of enthusiasm about how groundbreaking it would be if realized. One BCH community member noted “Once this is fully functional this will be a game changer for BCH — I wouldn’t be surprised to see more darknet markets accepting BCH alongside BTC and monero.” Even non-BCHers were interested, as Wasabi Wallet developer @nopara73 had emphasized “CashFusion gives me goosebumps. It reminds me of the Knapsack paper.”

So what’s the breakdown? Here goes:

- Open-source.

- Built into the Electron Cash (mobile and desktop) and Stack wallets (as a simple toggle on/off).

- Audited by Kudelski Security.

- Github summary:

To review the big picture, the final result is a large coinjoin transaction with many participants and many inputs and outputs. In the simplest form, this is achieved by players covertly sending their transaction components (inputs and outputs) to the server. The server then shares all the information with all players, the players sign all their inputs, then (covertly) send them back to the server, and finally the server again shares with everyone so that all players have everything necessary to assemble a valid transaction.

But, in order to add the blame capabilities (to allow banning a user who didn’t sign all her inputs), each player first creates a salted hash of each of his inputs and outputs, and sends them to the server. Once all the players have joined the pool and have sent their commitments, they then proceed to covertly announce their transaction components to the server over Tor.

If there is a problem with the transaction, each component is assigned to another player at random for verification. The owner of the component sends the secret information, encrypted with one of the communication keys that’s paired with each commitment.

To prevent players from cheating by using the same component in multiple commitments (by hashing it with a different salt), the salt value itself is also hashed and paired with the covert announcement of the transaction component.

If there is a problem during verification, the verifier reveals his private communication key to the server, and the server determines whether to blame the accused or the accuser. Finally, to prevent DOS attacks, the blame mechanism will kick out the bad player and attempt the round again with one less player. The process can be repeated as many times as desired.

In other, more current news, the upcoming BCH network upgrade set for May 2025 could open the door for Bitcoin Cash’s already existing UTXO smart-contract capabilities to be leveraged for integrating greater privacy via “Cash Covenants.”

The basic idea would be implementing numerous transactions behind the scenes in a contract, obfuscating participant information. As BCH developer Jason Dreyzehner puts it: “if Monero’s Full-Chain Membership Proofs were implemented as a BCH covenant, all transactions within the vault should be equally likely to have descended from any other previous vault transaction (and likewise for each withdrawal/unwrap).”

The upcoming BCH “VM [Virtual Machine] Limits” and “BigInts” upgrades could allow for the network fortitude needed to make such privacy solutions more than feasible, without risky changes to the foundational Bitcoin Cash protocol. In other words, market participants on Bitcoin Cash could choose to participate only in privacy covenants/contracts they trusted, avoiding others, without worrying about changes to the foundational codebase of the network.

Conclusion: CashFusion and Crypto Innovation in Privacy Are Powering Right Along, Regardless of Carlson’s Fear-Mongering

It’s interesting that with CashFusion operating successfully now for many years, fusing 17.4 million BCH as of April 2023, and for fractions of a penny for a fuse, more people in crypto privacy circles aren’t talking about it. But maybe that is a good thing.

Those who know about it can use it and enjoy privacy on the Bitcoin Cash network. It’s even been suggested that maybe that is why Ver was quiet on the matter — perhaps he wanted to keep the protocol from being a more prominent state target. Or maybe he was instructed (read: threatened) not to mention it. Hell, to be frank, maybe I shouldn’t even be writing this. But it’s exciting, and I hope more people find out about it and use it.

And what of the other competing privacy solutions he mentioned, like Zano and XMR and “Confidential Layer”? I hope to address these in subsequent articles, so please stay tuned.

For the time being, remember, if the talking heads of the media and agents of the state are repeating something over and over, such as crypto can never be (even relatively) private, there is probably a reason for that. They don’t have the resources or manpower to deal with even mild permissionless adoption and use, let alone a critical mass of non-compliant freedom advocates exchanging in peace and refusing to fund the violent actions of the state to whatever degree possible. So what do they do? Crank up the fear machine, as always.

Disclaimer: This article is not investment advice or any kind of advice at all.